Are you considering investing in an EcoFlow Delta Pro to power your home or outdoor adventures? One of the first questions many ask is: does it qualify for federal tax credits? The answer is… it depends! While the EcoFlow Delta Pro itself doesn’t automatically qualify, it can qualify when paired with qualifying solar panels and potentially other home energy solutions. This guide will break down everything you need to know about claiming tax credits with your EcoFlow Delta Pro in 2025.

The EcoFlow Delta Pro is a powerful home backup and portable power station, but navigating the complexities of tax incentives can be frustrating. We’ll cover the key requirements, eligible combinations, and steps to maximize your savings, ensuring you get the most out of your investment.

Understanding the Federal Tax Credits

The Inflation Reduction Act of 2022 introduced significant tax credits for clean energy investments. These credits are designed to encourage homeowners to adopt renewable energy sources and enhance energy efficiency. The two main credits relevant to the EcoFlow Delta Pro are:

- The Residential Clean Energy Credit (25D): This credit covers the cost of solar panels, battery storage, and other qualified clean energy property.

- The Energy Efficient Home Improvement Credit (25C): This credit applies to certain energy-efficient upgrades to your home, which could include components used in conjunction with the Delta Pro.

Key Requirements for Qualification

To qualify for these credits, several requirements must be met:

- New Property: The equipment must be new, not used.

- US Location: The property must be installed at a US residence.

- Taxpayer Liability: You must have tax liability to claim the credit. The credit is non-refundable, meaning you can’t get money back if the credit exceeds your tax owed.

- Proper Documentation: You’ll need to retain receipts and documentation to support your claim.

Does the EcoFlow Delta Pro Qualify on its Own?

Generally, no. The EcoFlow Delta Pro, as a standalone portable power station, does not automatically qualify for the federal tax credits. It’s considered a consumer electronic device. However, its eligibility dramatically increases when integrated into a qualifying home energy system.

Qualifying the EcoFlow Delta Pro with Solar Panels (25D Credit)

This is the most common way to make your EcoFlow Delta Pro tax credit eligible. The 25D credit covers 30% of the cost of qualified clean energy property, including:

- Solar Panels: The primary component for generating renewable energy.

- Battery Storage: This is where the EcoFlow Delta Pro comes in! When paired with solar panels, it stores the energy generated for later use, making your system eligible.

- Inverters: Necessary to convert DC power from solar panels to AC power for your home.

- Wiring and Accessories: Essential components for a functioning system.

Specifics for EcoFlow Delta Pro Integration

- System Size: There is no maximum system size limit for the 25D credit.

- Grid Integration: The system can be grid-tied or off-grid.

- Installation: While you can DIY a solar + Delta Pro system, professional installation isn’t required, but it’s highly recommended for safety and compliance.

- Cost Considerations: The 30% credit applies to the total cost of the qualifying system, including the solar panels, Delta Pro, inverters, and installation (if applicable).

Utilizing the Energy Efficient Home Improvement Credit (25C)

The 25C credit offers a tax credit for making energy-efficient improvements to your home. While less directly applicable to the Delta Pro, certain components used to integrate it into your home’s energy system might qualify.

Eligible Components

- Electrical Upgrades: If you need to upgrade your electrical panel or wiring to accommodate the Delta Pro and solar system, these costs could be eligible.

- Energy Management Systems: Smart home energy management systems designed to optimize energy usage with the Delta Pro might qualify.

Limitations of the 25C Credit

- Credit Cap: The 25C credit has an annual limit.

- Specific Requirements: The components must meet specific energy efficiency standards to qualify.

Step-by-Step Guide to Claiming Your Tax Credit

- Document Everything: Keep all receipts, invoices, and warranty information for all purchased equipment (solar panels, EcoFlow Delta Pro, inverters, wiring, etc.).

- Determine Your System Cost: Calculate the total cost of your qualifying energy system.

- Calculate the Credit: Multiply the total cost by 30% (for the 25D credit) or follow the specific guidelines for the 25C credit.

- Complete Form 5695: This is the form you’ll use to claim the Residential Energy Credits. You can find it on the IRS website.

- File with Your Taxes: Submit Form 5695 along with your annual tax return.

Pro Tips for Maximizing Your Tax Credit

- Plan Your System: Carefully plan your entire system (solar panels, Delta Pro, accessories) to ensure all components qualify for the credit.

- Professional Consultation: Consult with a solar installer or energy efficiency expert to ensure your system meets all requirements.

- Stay Updated: Tax credit rules can change. Check the IRS website for the latest information.

- Consider State & Local Incentives: In addition to federal credits, many states and local governments offer incentives for renewable energy investments.

- Keep Detailed Records: Maintain a well-organized file of all documentation related to your energy system.

When to Seek Professional Help

- Complex Systems: If you’re installing a large or complex solar + storage system, consult with a qualified installer.

- Tax Questions: If you’re unsure about your eligibility or how to claim the credit, seek advice from a tax professional.

- Permitting and Inspections: Ensure your system complies with all local permitting and inspection requirements.

FAQ

Q: Can I claim the tax credit if I install the solar panels and EcoFlow Delta Pro myself?

A: Yes, you can! The IRS doesn’t require professional installation, but it’s crucial to ensure the system is installed safely and correctly.

Q: What if the tax credit is more than I owe in taxes?

A: Unfortunately, the credit is non-refundable. You can’t receive the excess amount back as a refund. However, you may be able to carry the credit forward to future tax years.

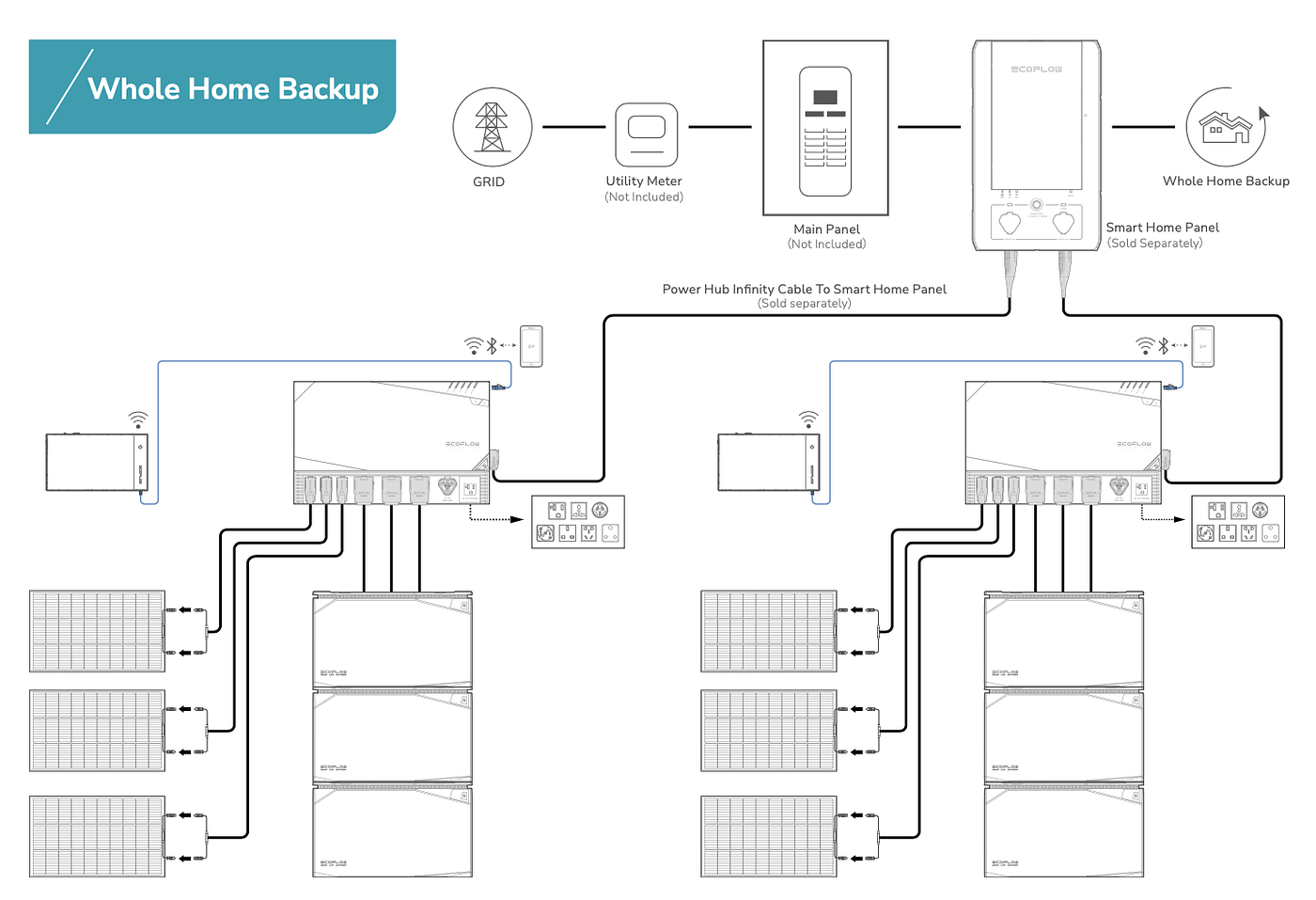

Q: Does the EcoFlow Smart Home Panel qualify for any tax credits?

A: The EcoFlow Smart Home Panel itself doesn’t directly qualify, but it’s a component that facilitates a qualifying solar + storage system, and its cost is included in the total system cost eligible for the 25D credit.

Q: Where can I find more information about the tax credits?

A: Visit the IRS website: https://www.irs.gov/credits-deductions/residential-clean-energy-credits

Get Your EcoFlow Delta Pro Tax Credit Today!

By pairing your EcoFlow Delta Pro with qualifying solar panels, you can unlock significant tax savings while building a more sustainable and resilient energy system. Remember to document everything, plan carefully, and stay informed about the latest tax credit rules. Don’t miss out on this opportunity to reduce your energy costs and contribute to a cleaner future.

Ready to start saving? Share your plans for using the EcoFlow Delta Pro and tax credits in the comments below!