Are you considering Titan Solar for your home energy needs and wondering about their stability and experience? It’s crucial to know how long a solar company has been around before entrusting them with a significant investment. While recent growth is impressive, a proven track record speaks volumes. Fortunately, Titan Solar has established itself as a significant player in the industry, and understanding its business history can provide peace of mind.

This comprehensive guide will detail Titan Solar’s founding, growth trajectory, financial standing, and what their longevity means for you as a potential customer. We’ll cover key milestones, address recent changes, and provide insights into their current market position, helping you make an informed decision.

Titan Solar’s Founding and Early Years

Titan Solar was founded in 2012 by Kevin Lloyd and Dustin Houchin in San Diego, California. Initially, the company focused on direct sales of solar energy systems, primarily in the California market. Their early business model centered around a door-to-door sales approach combined with a strong emphasis on customer acquisition through marketing.

- 2012-2016: Initial Growth & California Focus: These years were characterized by rapid expansion within California, driven by aggressive sales tactics and the state’s supportive solar policies. Titan Solar quickly established itself as a prominent regional player.

- Early Challenges: Like many rapidly growing startups, Titan Solar faced challenges related to scaling operations, maintaining quality control, and managing customer service demands. Initial reviews reflected these growing pains.

Expansion and Acquisition by Titan Acquisition Holdings

A significant turning point for Titan Solar came in 2021 when it was acquired by Titan Acquisition Holdings, a special purpose acquisition company (SPAC). This acquisition marked a major shift, injecting substantial capital into the business and paving the way for national expansion.

The SPAC Merger & Public Listing

In December 2021, Titan Solar completed its merger with Titan Acquisition Holdings, becoming a publicly traded company under the ticker symbol TTS. This provided access to public markets for funding and further accelerated growth plans.

- Funding Boost: The SPAC merger raised approximately $175 million, earmarked for expansion into new markets, technology development, and strengthening the company’s infrastructure.

- National Expansion: With increased capital, Titan Solar began aggressively expanding its operations beyond California, targeting states with favorable solar policies and high energy costs, including Texas, Nevada, and Florida.

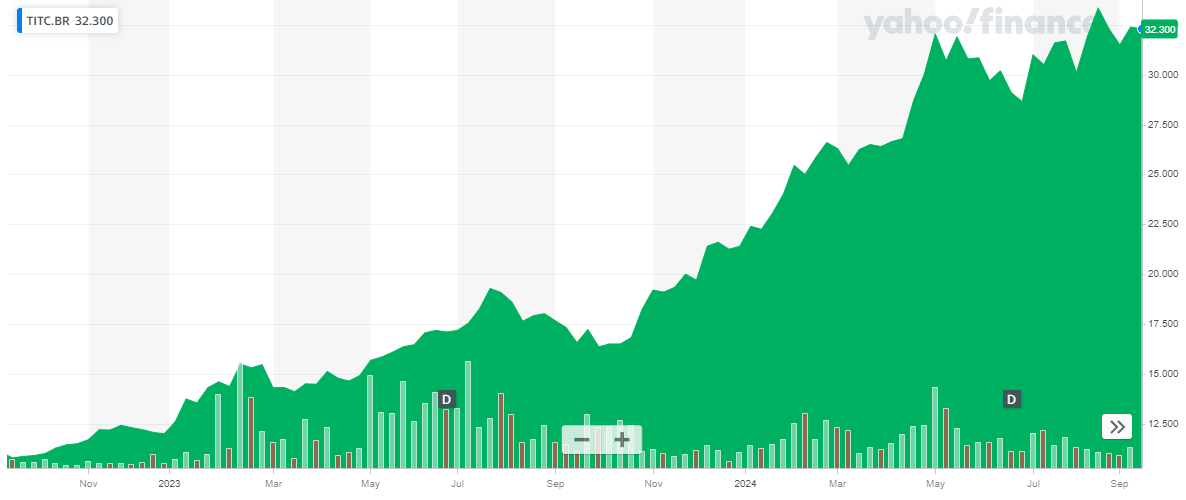

Recent Developments & Financial Performance (2022-2024)

The period following the SPAC merger has been marked by both significant growth and substantial challenges. The company has experienced rapid revenue increases but has also faced financial headwinds, including rising interest rates and a more competitive solar market.

Revenue Growth & Market Share

Despite market volatility, Titan Solar experienced significant revenue growth in 2022 and 2023, fueled by its expanded sales network and increased demand for solar energy.

- 2022 Revenue: Approximately $348.4 million

- 2023 Revenue: Approximately $478.9 million

- Market Position: Titan Solar has consistently ranked among the top 10 residential solar installers in the United States.

Financial Challenges & Restructuring (Late 2023 – 2024)

Late 2023 and early 2024 saw Titan Solar facing mounting financial difficulties. Rising interest rates, increased competition, and challenges with supply chain logistics contributed to declining profitability and a significant drop in stock price.

- Layoffs & Cost Cutting: In January 2024, Titan Solar announced significant layoffs, impacting approximately 28% of its workforce, as part of a broader restructuring plan to reduce costs.

- Chapter 7 Bankruptcy Filing (March 2024): On March 7, 2024, Titan Solar and several of its subsidiaries filed for Chapter 7 bankruptcy protection. This means the company is liquidating its assets to pay off creditors.

- Suspension of Operations: Following the bankruptcy filing, Titan Solar ceased operations, including all sales and installation activities.

What Titan Solar’s History Means for Existing and Potential Customers

The bankruptcy of Titan Solar raises serious concerns for both current and former customers. Here’s a breakdown of the implications:

- Existing Customers with Installations: Customers with completed installations are generally not directly impacted by the bankruptcy, as the warranties are often backed by third-party providers. However, accessing warranty support may be complicated.

- Customers with Pending Installations: Unfortunately, customers with pending installations are unlikely to have them completed. They are considered creditors in the bankruptcy proceedings and may recover a small percentage of their deposits.

- Warranty & Service Concerns: The biggest concern for existing customers is the long-term viability of warranty and service support. Titan Solar is no longer able to provide these services directly.

- Potential for Lawsuits: Numerous lawsuits have been filed against Titan Solar alleging fraudulent practices and breach of contract.

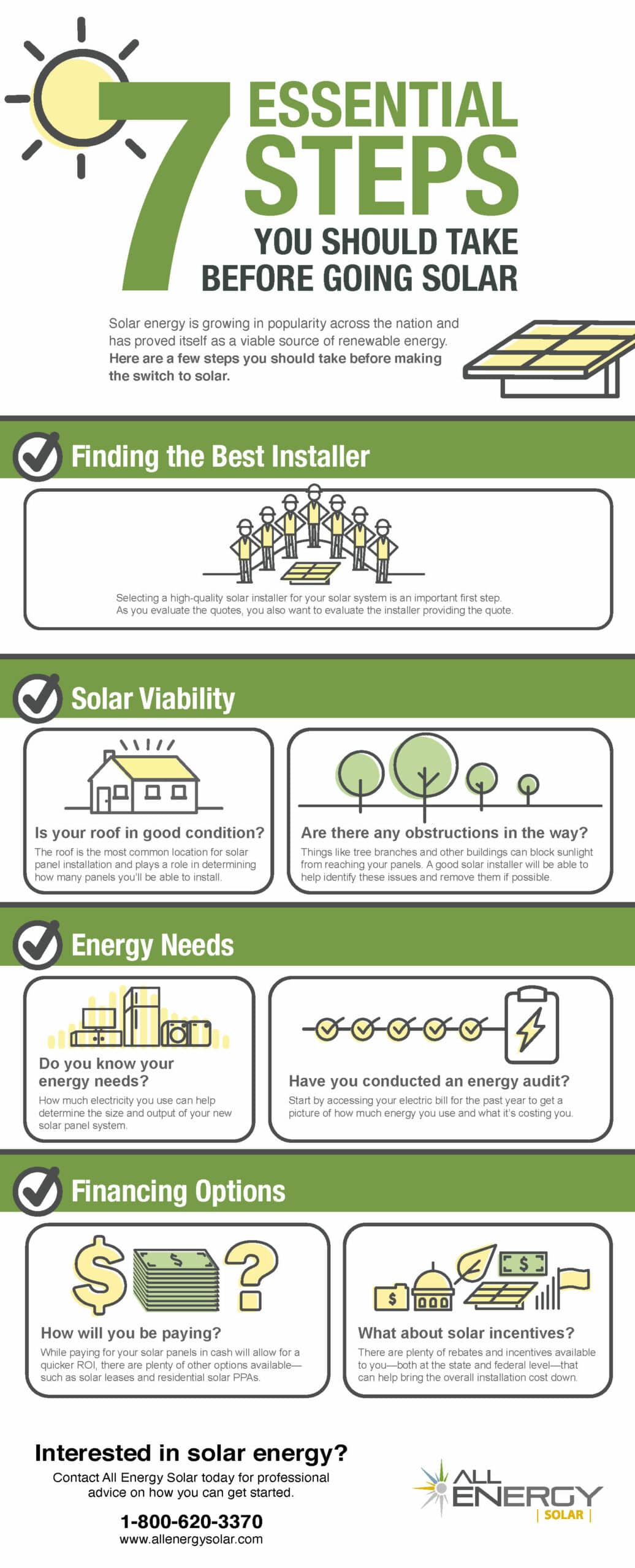

Pro Tips: What to Look for in a Solar Company

Given the situation with Titan Solar, it’s more critical than ever to thoroughly vet any solar company you consider.

- Years in Business: Prioritize companies with a long and stable track record.

- Financial Stability: Research the company’s financial health and look for independent ratings.

- Customer Reviews: Check online reviews from multiple sources (BBB, Google, Yelp) and pay attention to patterns of complaints.

- Warranty Coverage: Understand the terms of the warranty, including who provides it and what it covers.

- Local Presence: Choose a company with a strong local presence and a reputation for reliable service.

Professional Help: Seeking Legal Advice

If you are a former Titan Solar customer, especially one with a pending installation, it’s highly recommended to consult with an attorney specializing in bankruptcy and consumer protection law.

- Legal Options: An attorney can advise you on your legal options for recovering losses.

- Creditor Claims: They can assist you in filing a claim in the bankruptcy proceedings.

FAQ

Q: What happens to my Titan Solar warranty?

A: Your warranty is likely backed by a third-party provider. Contact the warranty provider directly to understand your coverage and how to file a claim.

Q: Will I get my deposit back if I had a pending installation?

A: It is unlikely you will receive a full refund. You will be considered a creditor in the bankruptcy proceedings and may receive a small percentage of your deposit.

Q: Is it still worth investing in solar energy?

A: Absolutely. Solar energy remains a viable and attractive option for homeowners. However, it’s crucial to choose a financially stable and reputable company.

Q: How can I find a reliable solar installer?

A: Research companies thoroughly, read customer reviews, and get quotes from multiple providers. Look for companies with a long track record and strong financial stability.

Start Fresh with a Reliable Solar Provider

The story of Titan Solar serves as a cautionary tale. While the company initially showed promise, its rapid growth and subsequent financial troubles highlight the importance of due diligence when selecting a solar provider.

Don’t let this discourage you from embracing solar energy. By carefully researching and choosing a reputable company with a proven track record, you can enjoy the benefits of clean, affordable energy for years to come.

Are you ready to explore solar options with a trusted and stable provider? Share your questions in the comments below, and we’ll help you get started!